- #Compare auto insurance rates by zip code drivers

- #Compare auto insurance rates by zip code full

- #Compare auto insurance rates by zip code code

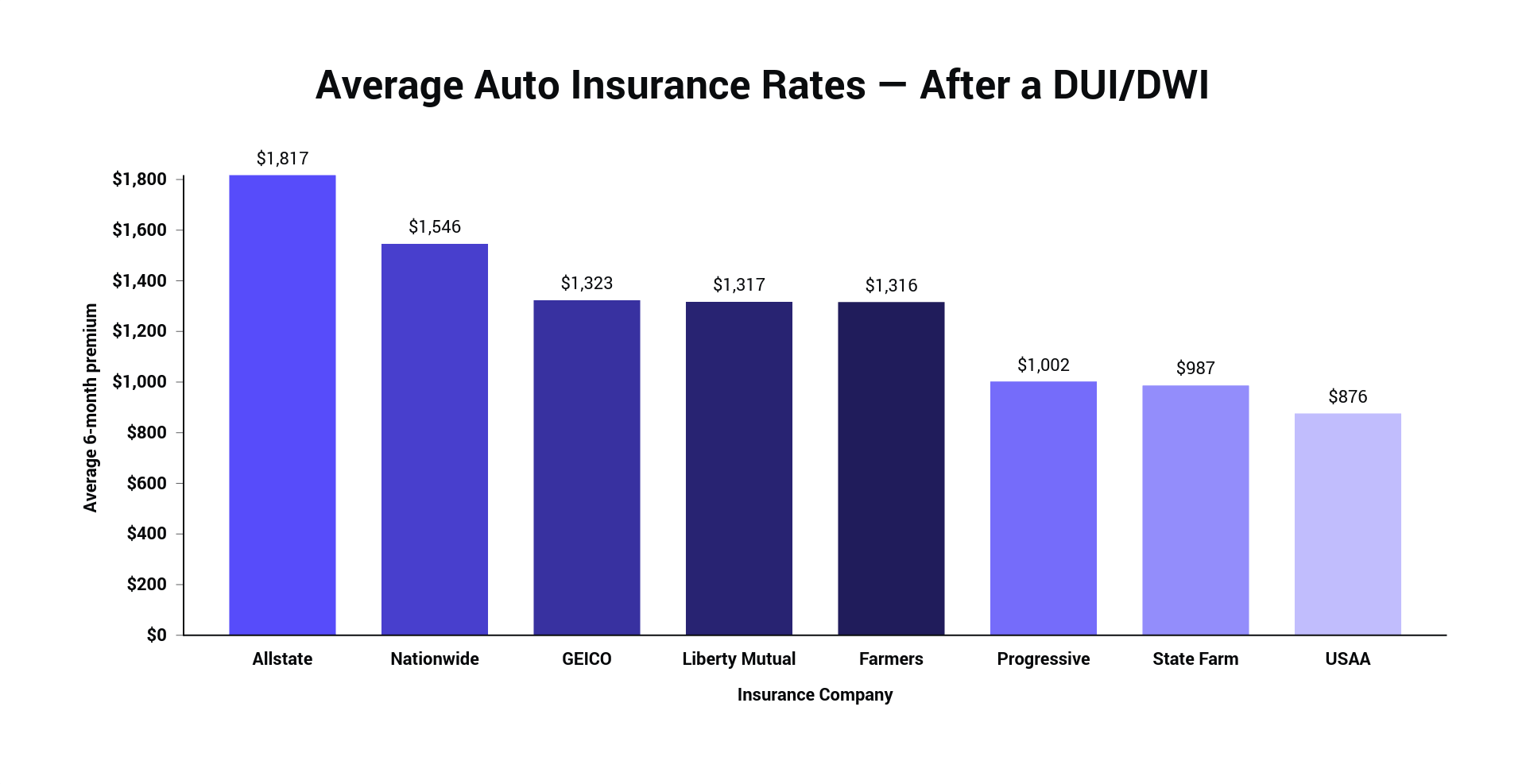

Credit Score: Good credit lowers your car insurance rates. Paying your entire yearly bill at one time, instead of in installments, may lead to a discount. Payment Plan: Some insurance companies offer discounts based on your payment plan. Multiple Policies: If you have more than one car and/or also have homeowner or renter's insurance, keep in mind that many insurance companies offer discounts based on the number of policies that you have with them. Accident Prevention Training: Some companies offer discounts if you take a driver's education training course. Safety Devices: Airbags and anti-lock brakes both work in your favor by keeping you safer and lowering your insurance bill. Theft Deterrent Systems: If you have an alarm on your car, you'll pay less to insure your vehicle. Driving Habits: The number of miles that you drive, whether or not you use your car for work, and the distance between your home and work all play a role in determining your rates. Looking into the cost of insurance before you purchase that new car could help you save a bundle on your car insurance. Vehicle Choice: Sports cars cost more to insure than sedans, and expensive cars cost more to insure than cheap ones do. Obey the law to help keep your rates from rising. Moving Violations: Speeding and other moving violations all have a negative impact on your insurance bill. If you want to keep your rates low, keep the number of claims that you file to a minimum. #Compare auto insurance rates by zip code drivers

Claims: Accident-prone drivers pay more. According to the Insurance Research Council, these states have the greatest concentrations of uninsured motorists, which ultimately seeps into insured drivers' premiums.

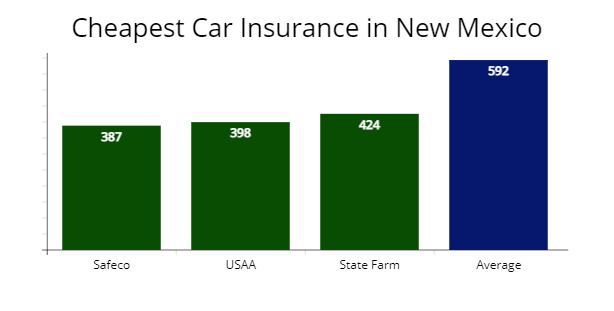

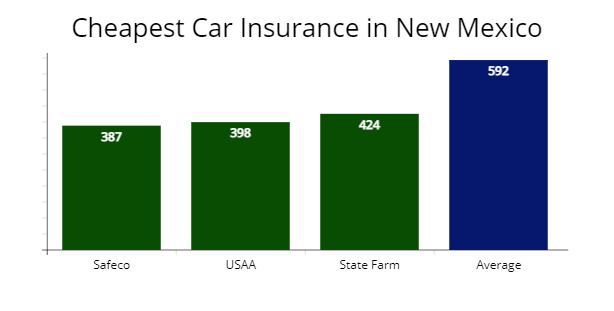

If you've recently taken up residence in New Mexico, Alabama, Oklahoma or Florida, expect to pay higher premiums. Additionally, more people living in an area means more claims, which is reflected in the higher premium prices in such places.

#Compare auto insurance rates by zip code code

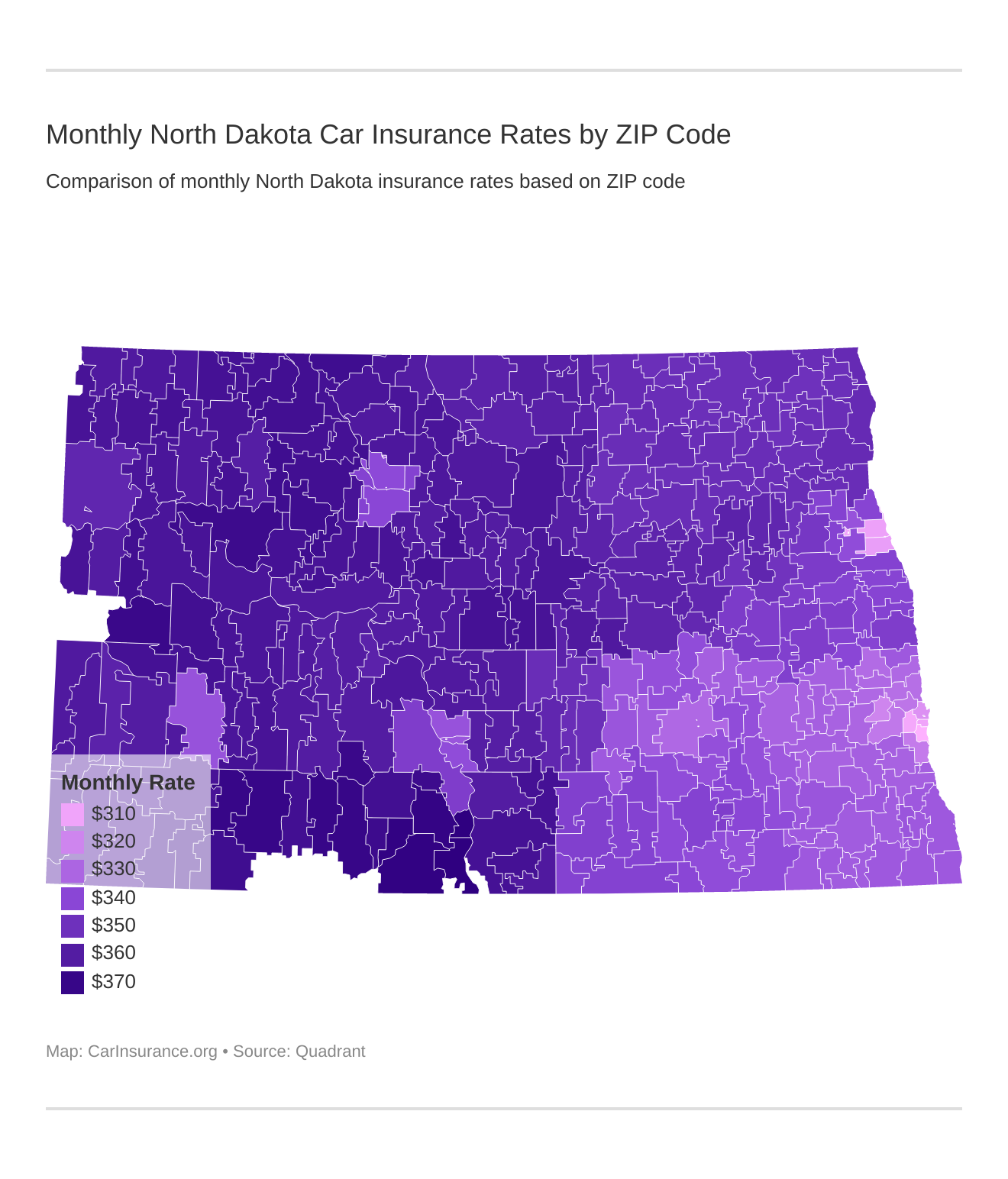

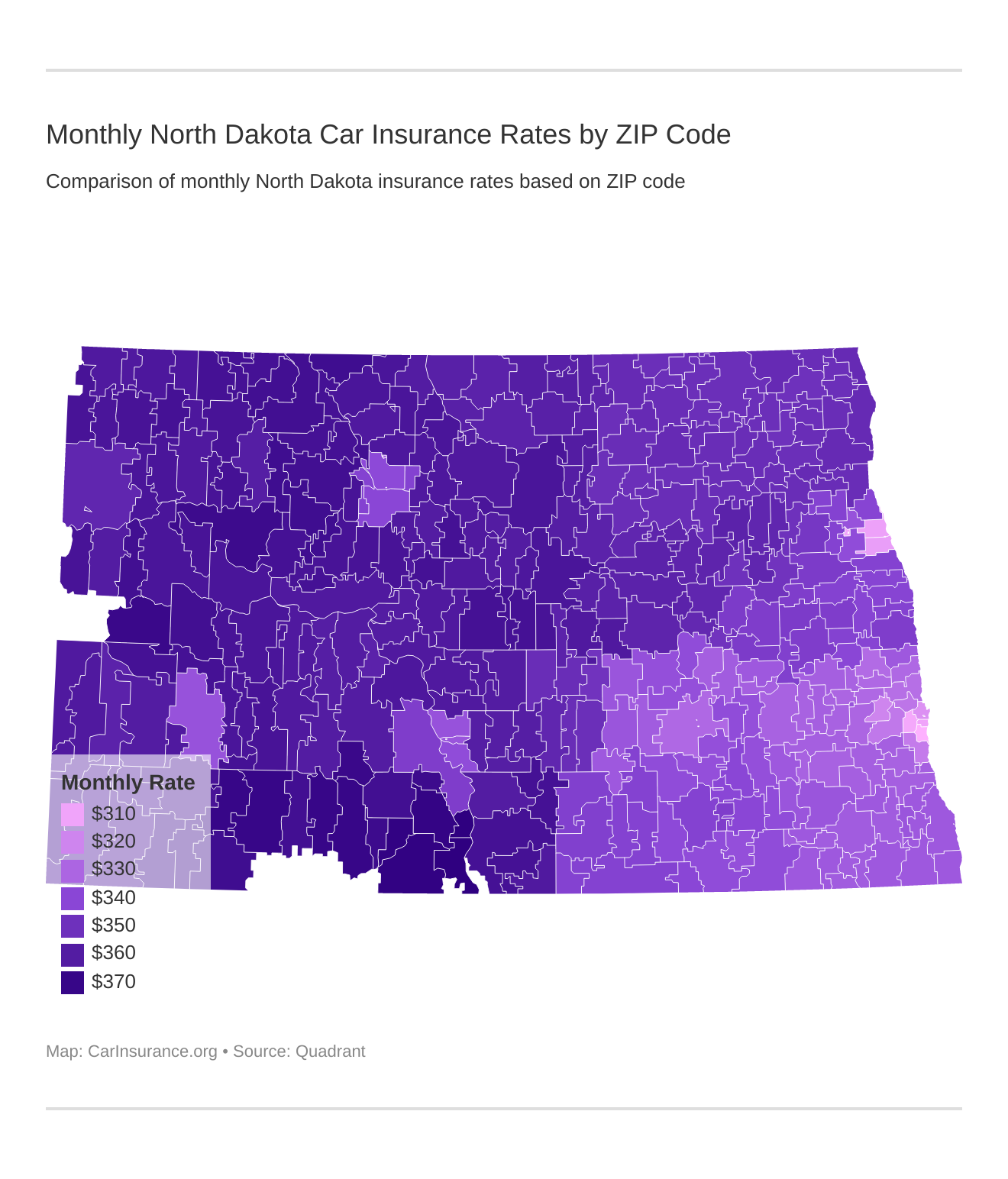

Demographics: Though actual risk is determined by the zip code you live in, city residents statistically have more accidents, which drives their premiums higher than those who live in rural areas. Gender: Men have higher rates than women. Age: Younger, less experienced drivers have higher insurance rates. In general, a deductible of at least $500 is worth considering, as damage to your vehicle that comes in at less than $500 can often be paid without filing an insurance claim. The higher your deductible, the lower your insurance bill. Your deductible: This is the amount of money that you pay out of your own pocket if you get in an accident. If you are leasing a vehicle or purchasing a vehicle with a low, or no, down payment, gap insurance is a great idea. Gap insurance pays the difference between the blue book value of a vehicle and the amount of money still owed on the car. The same thing applies if your new set of wheels gets stolen. Gap: If you demolish that $35,000 sport utility vehicle 10 minutes after you drive it off the lot, the amount the insurance company pays is likely to leave you with no vehicle and a big bill.

Rental: This insurance option covers the cost of a rental car, but rental cars are so inexpensive that it may not be worth paying for this coverage.In general, this coverage is not worth the long-term cost. Glass Breakage: Some companies do not cover broken glass under their collision or comprehensive policies.If you are a member of an automobile service, or if your vehicle comes with roadside assistance provided by the manufacturer, this coverage is unnecessary.

Towing: Towing coverage pays for a tow if your vehicle cannot be driven after an accident.Uninsured/Underinsured Motorist Coverage: This option provides for medical and property damage coverage if you are involved in an accident with an uninsured or underinsured motorist.If you have good health insurance coverage, this may not be necessary. Medical Payments/Personal Injury Protection: Personal injury protection pays the cost of medical bills for the policyholder and passengers.However, giving up your rights is rarely a smart financial move.

#Compare auto insurance rates by zip code full

Full Tort/Limited Tort: You can reduce your insurance bill by a few dollars if you give up your right to sue in the event of an accident.

0 kommentar(er)

0 kommentar(er)